MCB Disclaimer

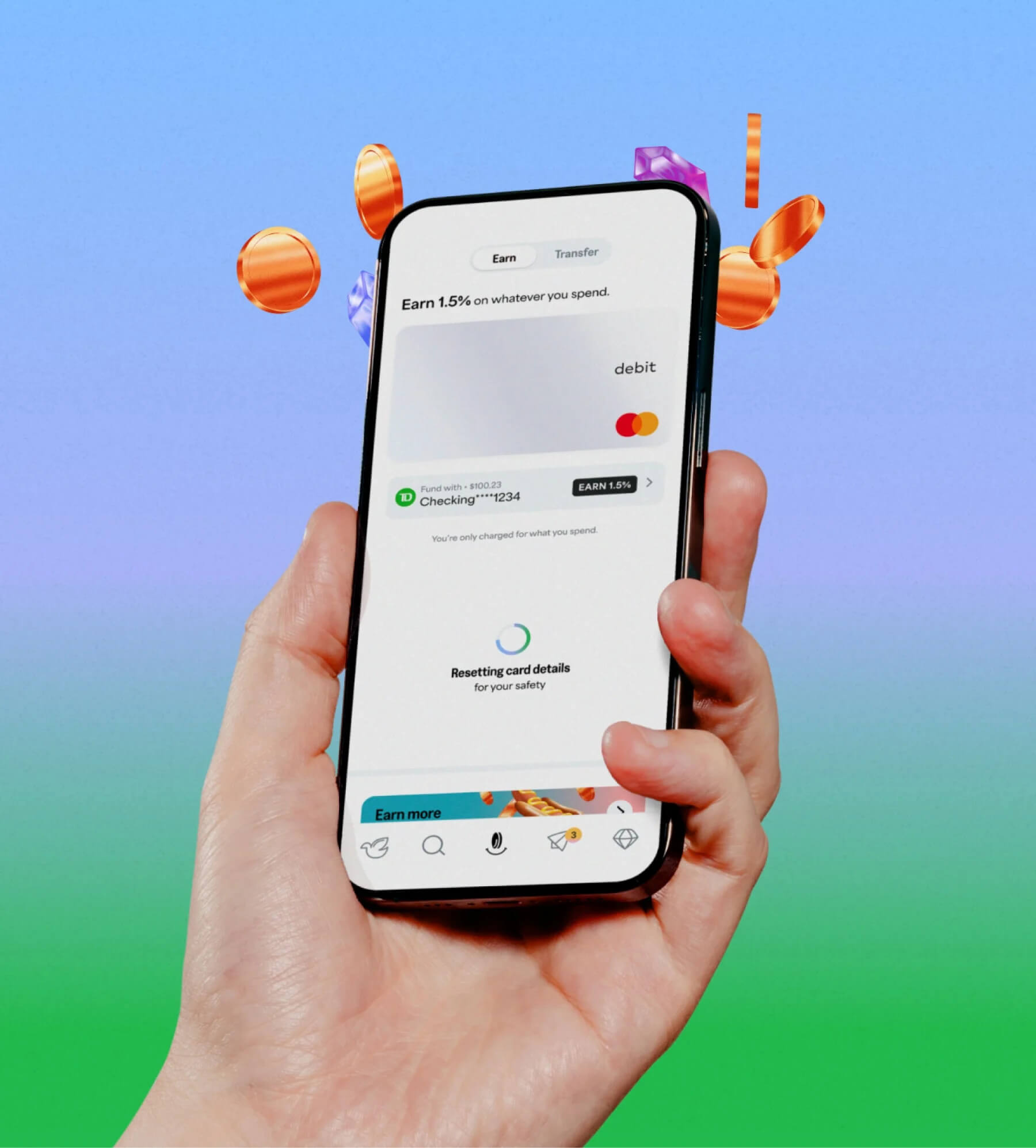

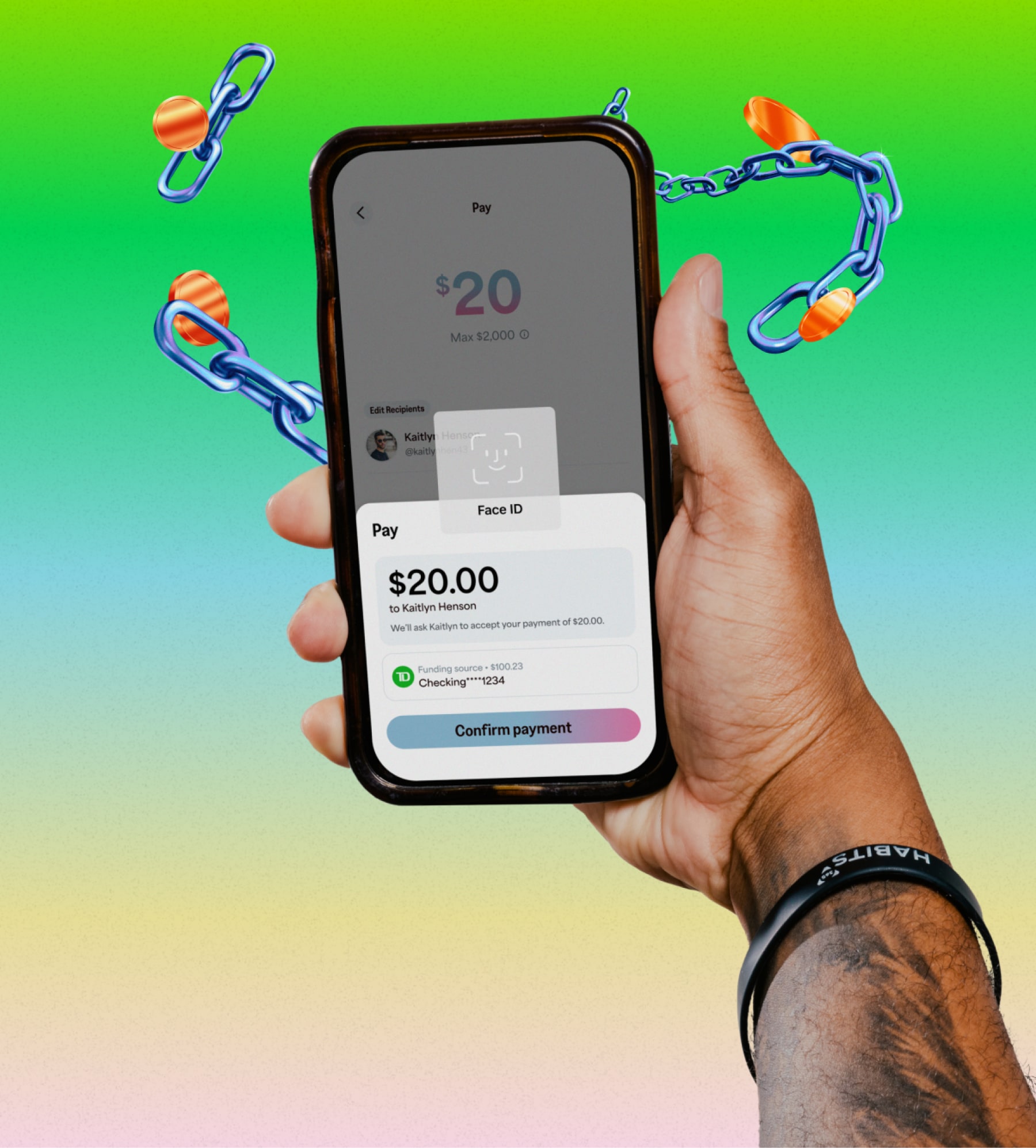

Banking Services provided by Metropolitan Commercial Bank, Members FDIC. The deposits held in the digital wallet are secured with Metropolitan Bank's FDIC insurance. This covers deposits up to $250,000 held at Metropolitan Commercial Bank. Click here for more information about FDIC Insurance. Fluz does not have FDIC insurance. Fluz is not holding customer deposits. Fluz rewards are not insured by FDIC.