Disclaimer

Please note rates are subject to change on select merchants. Please check merchant listing pages in the Fluz application to see the exact cashback rate offered on that transaction.

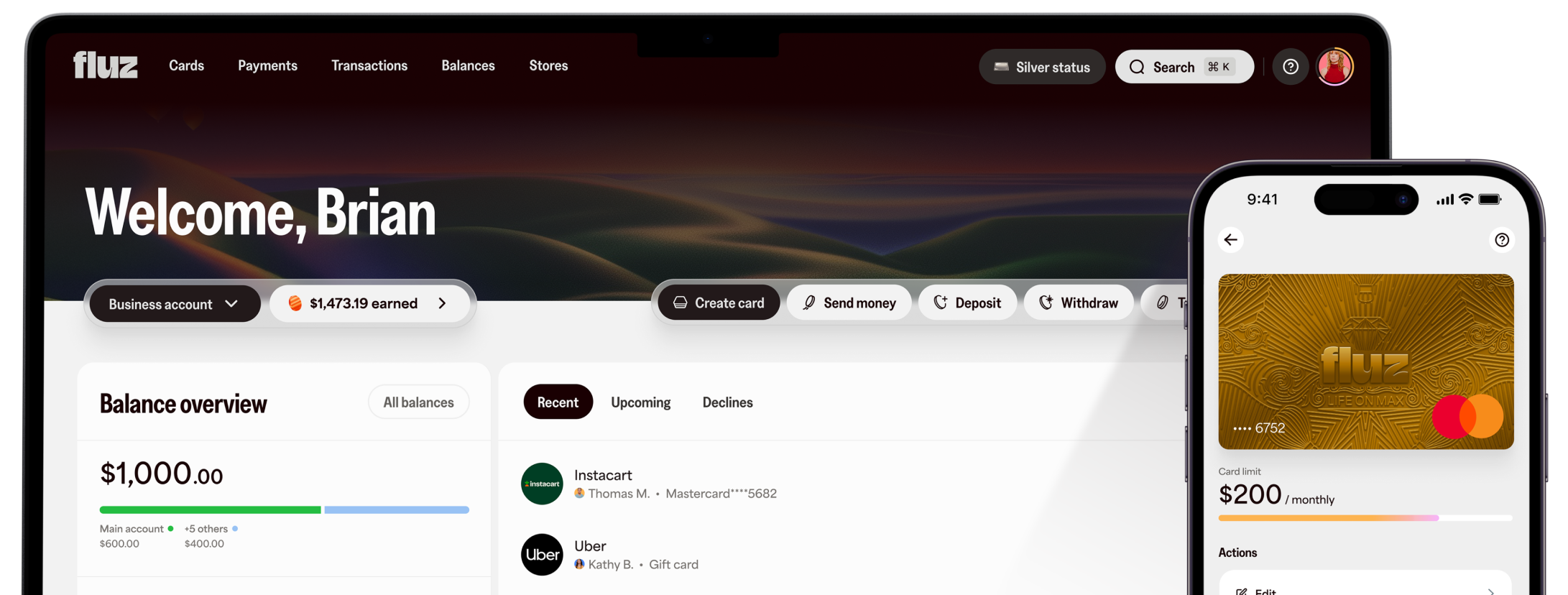

The Fluz Virtual Card is issued through partner banks, members FDIC, pursuant to a license from Mastercard International. When generating the Fluz Virtual Card, the financial institution issuing the card will be listed.

Please see terms & conditions of listed partner bank when generating virtual card.

Fluz Virtual cards work online everywhere Mastercard is accepted. Fluz Virtual cards work in-store everywhere ApplePay or GooglePay is accepted in stores.